Sign up for our Newsletter

Receive the latest updates on Latvia’s business environment, economic developments, and investment opportunities.

12.01.2023 - Economy

You don’t have to look far to find a complaint about the Latvian tax system, particularly the supposedly abnormally high tax burden placed on entrepreneurs.

While the grass is always greener on the other side, I thought I’d investigate where Latvia stands when comparing tax rates that apply to businesses with those of other countries.

Is Latvia’s business tax burden absurdly high? Let’s find out, once and for all.

European and US business tax rates, side by side

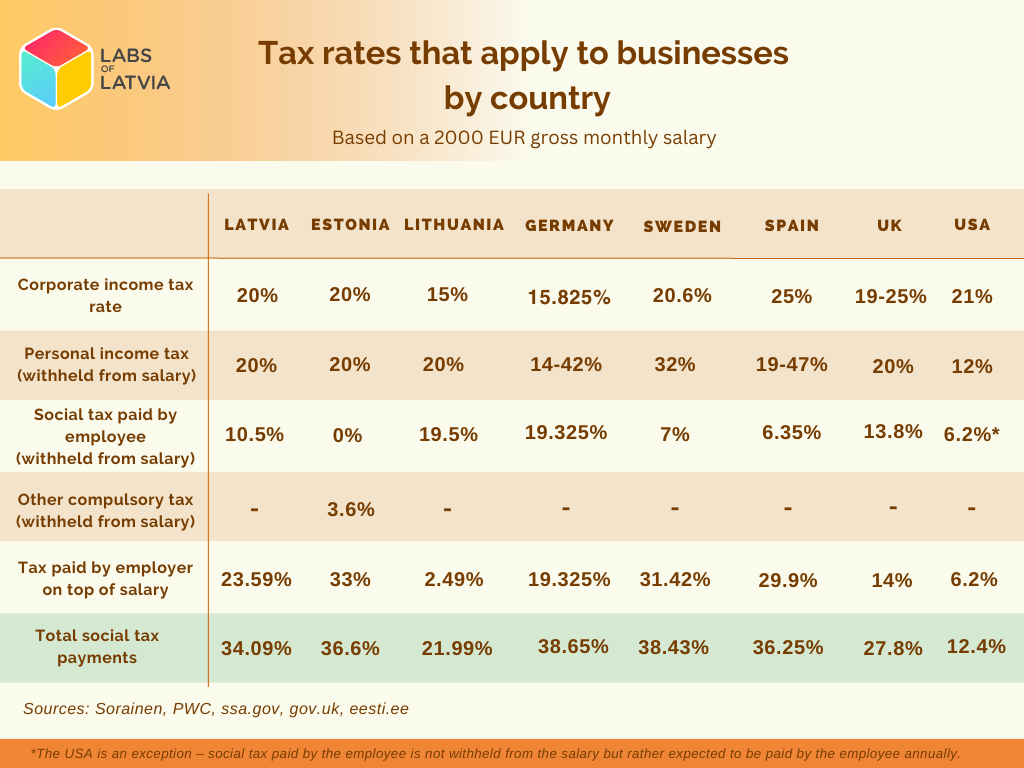

To have a better understanding of where Latvia lies in terms of friendly tax policies, we have to have a better idea of what else is out there. Naturally, the first comparison layer had to be the Baltic states. For a broader overview, we added a few major European economies – Germany, Spain, and the UK, as well as the USA for a transatlantic perspective, and Sweden as another country with mythically high tax rates.

The compared taxes are those that apply to businesses. While the terminology changes from country to country, the general concept is the same across the countries we looked at. They all had a version of three main tax categories:

In most countries, social tax payment is divided between the employee (with part of their salary withheld) and the employer (who makes their payment on top of the employee’s salary). One exception is Estonia, where the employer makes the whole payment. Some countries, like Estonia and Lithuania, have additional compulsory tax contributions on top of the social tax. For the sake of simplicity, we chose to compare the tax rates in countries for a EUR 2000 monthly salary.

Results

Results

The tax comparison table provides us with insight into the different approaches countries have in terms of taxation.

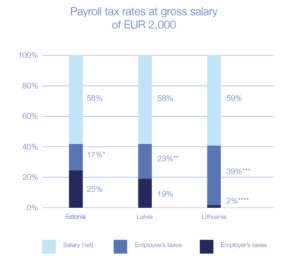

For example, throughout all of the Baltic countries, personal income tax is the same, and corporate income tax is at 20%, except for Lithuania’s, which is at 15%. The similarities in Baltic taxation are also easily observed in Sorainen’s Baltic Employment Card material, which demonstrates that though taxation rates differ, they end up resulting in similar employment taxation levels:

Personal income tax in the Baltics is for the most part fixed, while outside of the Baltics, in most cases, the tax is progressive, with higher incomes demanding a higher tax rate.

Larger differences can be observed when we get into the social tax area. There seem to be two main approaches to social taxation – one, where employers bear the brunt of paying social tax, and the other, where employees have a portion of their salaries withheld to contribute to the total social tax payment. Estonia is the only country we observed to have no social tax withheld from their salary (except for the 3.6% compulsory tax, which covers mandatory 1.6% unemployment insurance and 2% pension insurance), and 33% is paid by the employer on top of the gross salary.

The United States is an expected outlier in the comparison table. As a country with significantly fewer social security systems, it demands a lower rate of social tax, totaling 12.4%, equally split between employee and employer.

Where Latvia sits

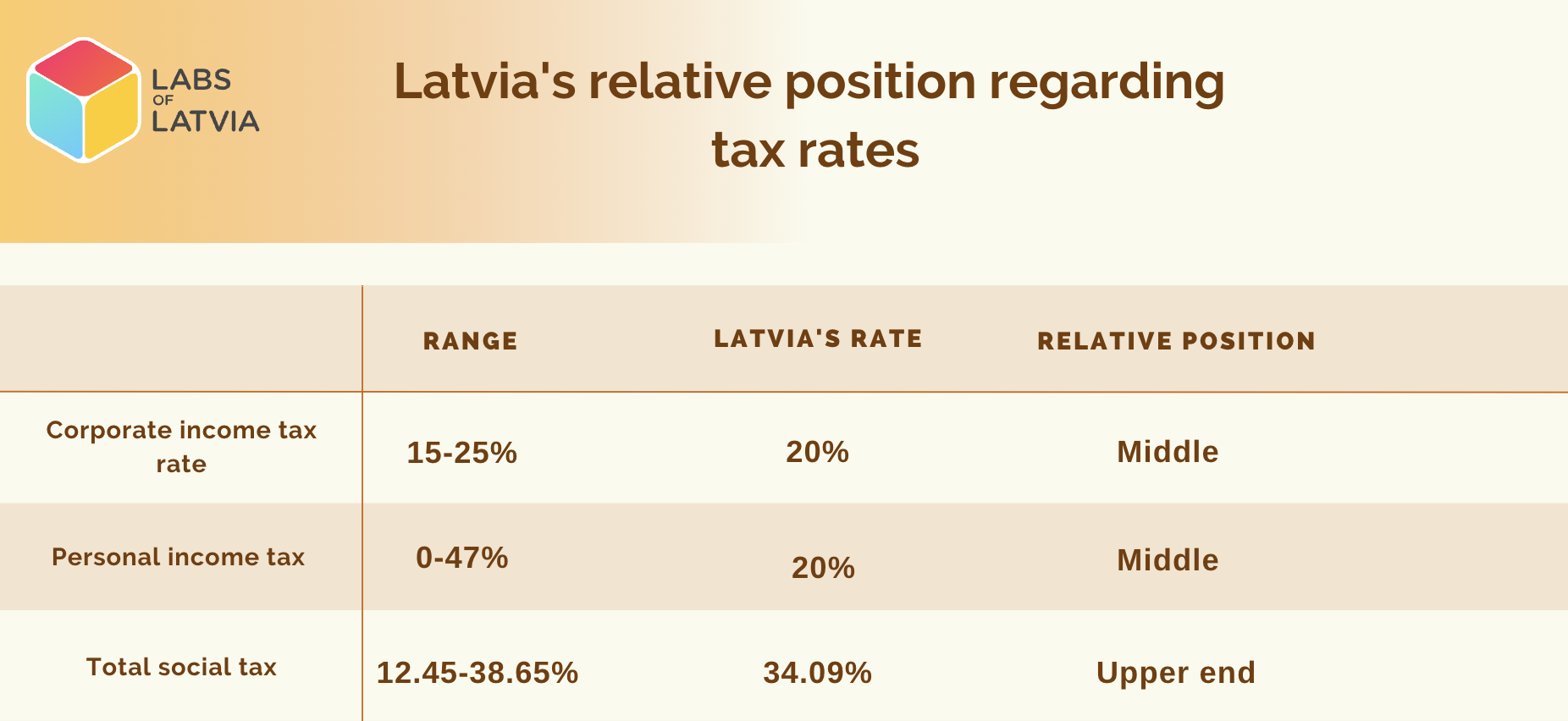

In all three major categories – corporate income, personal income, and social tax, Latvia is neither at the top nor the bottom of the compared rates.

Latvia’s ranking can be more easily observed by understanding where Latvia sits in the compared range. Here, we’ve laid out the observed tax range, compared it to Latvia’s rate, and that gives us the ability to see if Latvia’s tax rates are low, average, high, or the highest.

We see that in all cases, Latvia is not at the highest end of the observed tax range. In fact, if we look at the Baltics alone, Latvia falls between Estonia and Lithuania in terms of social tax. The US social tax rate also significantly brings down the social tax range. If we eliminate the US from the comparison, the observed European social tax range sits between 21.98% and 36.6%.

While corporate income tax rates in Estonia and Latvia are set at 20%, it should be noted that the actual amount of paid corporate income tax is in fact much lower, as both countries have policies that state that the tax is paid only when profit is paid out. These policies contribute largely to Estonia and Latvia taking the top positions in the 2022 International Tax Competitiveness Index, with Estonia at #1 and Latvia taking #2.

Sorainen partner and tax specialist Jānis Taukačs emphasises that this comparison would differ significantly, depending on different salary levels: “The bracket for applying 20% personal income tax in Latvia is just EUR 20,000 per annum (p.a.), but in Lithuania – almost EUR 102,000. For higher salaries (above EUR 78,000 p.a.) an employer in Estonia will withhold from just 21.6% or 23.6% from their salary, but in Latvia – 41.5%.”

He also provides insight as to where Latvia sits amongst the 38 OECD countries: “At the end of 2021, the OECD published statistics that Latvia has the 10th highest tax burden (as % of the total labour cost) among all the OECD member countries. On the other hand, by the OECD statistics Latvia has the lowest corporate tax revenues collected (as % of the total tax revenues). Of course, the global minimum corporate tax project may soon change the picture.”

What does that mean for the current big picture?

“For Western businesses the tax burden here may seem pretty mild compared to their countries, if we look at the higher brackets of the progressive taxation.” – Jānis Taukačs, Partner at Sorainen

Methodology

Comparing tax rates between countries is difficult – in most countries, many conditions and variables affect what the final tax rate will be. For the sake of simplicity, we’ve taken the baseline tax rate where possible for comparison, and compared social tax rates for a EUR 2000/month salary. We also did not include special tax programmes, such as Latvia’s startup tax regime, which offers significant benefits, as well as the expected digital nomad tax regime, that has yet to be announced.

Data for the tax rate comparison table was collected from Sorainen’s publicly available “Taxes in a Nutshell” document, PWC’s Tax Summaries page, as well as governmental pages for the US and UK. For a more in-depth analysis of tax rates and variable conditions, you’ll have to study them separately. For Baltic countries’ comparisons, see Sorainen’s tax overview document and the Estonian Riigiportal. Follow the links for Germany, Sweden, Spain, the UK, and the USA.

Is Latvia’s tax burden on businesses higher than others?

The conclusion we can come to is:

Latvia’s tax burden on businesses is average.

It is not the highest, and it is not the lowest. It sits squarely in the middle of the Baltic states and is less than those of Germany, Spain and Sweden.

What does this mean? While Latvia is at the higher end of the spectrum in social taxes, it’s still eclipsed by other very economically successful countries in Europe, including our neighbour Estonia. What then is holding us back from developing businesses and the next generation of unicorns? Certainly not our tax policies. We’ll have to look elsewhere for that.

Author: Julia Gifford (labsoflatvia.com). Photo: Shutterstock.

Receive the latest updates on Latvia’s business environment, economic developments, and investment opportunities.

Receive the latest updates on Latvia’s business environment, economic developments, and investment opportunities.